Mortgage Broker Perth

Your Trusted Mortgage Broker in Western Australia

At Southstead Finance, we specialise in providing tailored home lending advice and solutions for home buyers and investors. With over 20 years of experience, we’re here to help you achieve the freedom to live the life you want.

BOOK YOUR COMPLIMENTARY APPOINTMENT TODAY

Mortgage broker near me

The Right Solution for Your Home Loan Needs

Navigating the home loan market can be daunting, but with Southstead Finance, you’re in good hands. We understand the complexities of lending and are dedicated to providing sensible solutions tailored to your financial situation.

Southstead Finance does all the things a good broker should – help you make sense of your finances, connect you with the right lending solution to achieve your goals and challenge your way of thinking so you live ‘your life your way’.

Finance Broker

Why Choose Southstead Finance?

At Southstead Finance, we offer:

- 20+ Years of Experience: Leveraging nearly two decades of industry knowledge.

- Personalised Guidance: One-on-one support through the entire loan process.

- Deep Financial Analysis: Thorough assessment of your financial position.

- Tailored Solutions: Customised lending solutions to fit your needs.

Home Loan Broker

We'll find a Home Loan that suits You

We know the joy of owning your own home and how it sets you up for the future. And we want everyone to experience it. That’s why we share our specialised knowledge, to help you see new possibilities.

Getting started with Southstead Finance is easy. Book a complimentary appointment and we’ll provide you with a personal assessment to connect you with the right loan for your needs.

Our team is dedicated to making sense of your financial position and providing sensible lending solutions that help you achieve your dream of owning a home.

Online Mortgage Broker

Our Proven Process

Book a Complimentary Appointment

We’ll start by getting to know you and understanding your financial goals.

Review your

eligibility

We’ll work out what you can afford to borrow, find lender and product options to suit your situation.

SUBMITTING YOUR HOME LOAN APPLICATION

We will assist with the paperwork, apply for the loan and manage the process to settlement and beyond.

Home Loan specialist

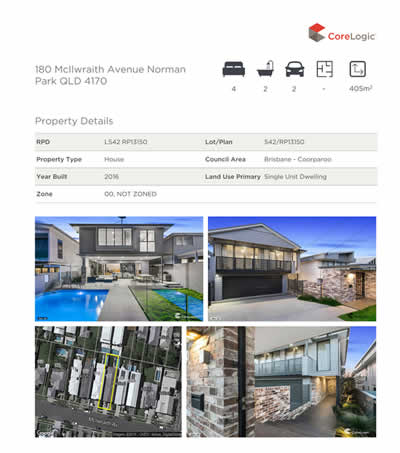

Receive your complimentary property profile report, contact us today.

The Property Profile Report is an invaluable tool for homeowners, especially in today’s dynamic market. It provides clients with a comprehensive snapshot of their property’s value, offering a detailed overview of key market metrics in residential real estate. The report includes vital data such as sales volumes, annual growth rates, rental information, and dwelling values by state. This information empowers clients to make informed decisions about their home, whether they’re considering selling, refinancing, or simply staying updated on market trends.

Here’s What Our Happy Clients Say

Home Loan Calculators

Like to Know How Much You Can Borrow?

Home Loan Professional

FAQs about Mortgage Brokers

What services does a mortgage broker provide?

Mortgage brokers offer personalised lending advice, helping you understand your borrowing capacity and eligibility. Connecting you with the most suitable lender and product options based on your individual situation and requirements.

How do I know if I need a mortgage broker?

If you want professional guidance and personalised advise, working with an experienced mortgage broker can help you through the complicated world of home loans. With access to multiple lenders, mortgage brokers must act responsibly and in your best interest when suggesting a loan for you.

What makes Southstead Finance different from other brokers?

Our 20+ years of experience, personal service, and strong client relationships and we offer flexible appointments, we can meet during the week, evenings and Saturdays and we can come to you.

Can Southstead Finance help with investment loans?

Yes, we specialise in both home and investment loans, providing tailored advice for each.

How do I get started with Southstead Finance?

Simply book a complimentary appointment, and we’ll guide you through the process.

Is there a fee for your services?

We offer a complimentary initial appointment to assess your needs and provide guidance. Most of the time we do not charge an upfront fee. We are able to do this because we earn commission from the lender when the loan settles which is how most mortgage brokers get paid. There maybe some instances an upfront commitment fee maybe required depending on the circumstances, of which a credit quote will be provided to you with full details for consideration before proceeding.