Home Loan Broker

Your Trusted Home Loan Broker in Western Australia

At Southstead Finance we know that finding the right home loan is just as important as finding the right property. That’s why we compare hundreds of loans from more than 30 of Australia’s most trusted lenders, finding one that matches your lifestyle and finance needs.

BOOK YOUR COMPLIMENTARY APPOINTMENT TODAY

Home Loan Broker near Me

A Home Loan for every situation

Buy Your First Home

Refinance Your Home Loan

Does your loan scrub up? Refinancing your home loan could be beneficial to your circumstances. With current interest rates being competitive and home loans more feature-rich than ever Southstead Finance can find the right home loan for you.

Buy An Investment Home

You’re expanding your portfolio and it’s time to make a choice. We’re investors ourselves and can mentor you through your next investment. We’ll help you define your investment goals, discover your borrowing power and find a loan to make your investment plans a reality.

Upsize or Downsize

Growing family or empty nest? Life is constantly changing, no matter your situation, or life stage, we’ll work with you and will provide you with the lowdown on your loan options and work out which one’s right for you.

Build Your Home

We’ll help you build a good foundation by finding the right loan to build your dream home. And applying for the right loan doesn’t need to be complex. We’ll help you understand the different features, rates and fees that apply. You’ll be in your new dream home before you know it.

Home Loan Professional

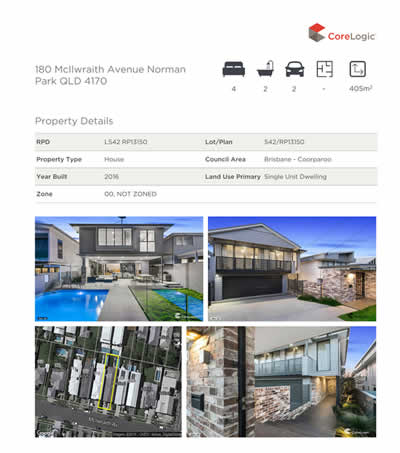

Receive your complimentary property profile report, contact us today.

The Property Profile Report is an invaluable tool for homeowners, especially in today’s dynamic market. It provides clients with a comprehensive snapshot of their property’s value, offering a detailed overview of key market metrics in residential real estate. The report includes vital data such as sales volumes, annual growth rates, rental information, and dwelling values by state. This information empowers clients to make informed decisions about their home, whether they’re considering selling, refinancing, or simply staying updated on market trends.

Calculate Home Loan

Like to Know How Much You Can Borrow?

Local Home Loan Broker

Types of Home Loans and Features

There are hundreds of different home loans available on the market, so many it can be confusing to find the right one. Southstead Finance make it easy and will help you to find a home loan that suits your financial and personal situation.

Fixed Rate Home Loans

A fixed rate home loan allows you to set your interest rate for a period of time. This is usually in the range of one to five years. You know exactly how much your repayments will be during your fixed rate term, which can make budgeting easier. Things to consider less flexibility, limited extra repayments, usually no offset or redraw facility. Potential early repayment/break costs and the rate is usually not set until the day of settlement unless a lock rate fee is paid.

Variable Rate Home Loans

Variable rate home loans are popular and offered by most lenders. With a variable rate loan, the interest rate you are charged can fluctuate in line with market interest rate changes. Because of this, your home loan repayments may also vary.

You can make extra repayments to pay off your home loan sooner. Making additional repayments above your minimum repayment amount can reduce the term of your loan and potentially reducing the amount of interest payable.

Interest Only Home Loans

With an interest only home loan, your repayments only pay the interest that is due and does not reduce the balance (or the amount you borrowed). As a result, an interest only loan can only be obtained for a limited period (usually up to five years).

At the end of the interest only period, the loan will automatically convert to a principal and interest loan unless you make an application to extend the interest only period.

First Home Buyers

Family Pledge Guarantee

Saving the deposit for your first home can be difficult and take a number of years. One way to potentially get into your own home sooner is by having a family member act as a guarantor.

Many lenders allow parents or someone who is close to you, to use the equity in their property as security for your home in lieu of you saving the full deposit required. This person is known as a guarantor.

Split

Home Loans

This type of home loan allows you to split your home loan into multiple loan accounts that attract different interest rates.

A common example is to split your home loan to obtain a variable interest rate on one portion of the loan and a fixed rate on the other.

Offset and Redraw

Home Loans

A mortgage offset account is a savings or transaction account that can be linked to your home loan. The balance in this account ‘offsets’ daily against the balance of your home loan before interest is calculated.

An offset account can help you cut years off your home loan term and could lower the interest payments.

A redraw facility lets you access any extra repayments you’ve made on your home loan, helping manage your cashflow.

Line of Credit

This can help you turn the equity in your home into money you can actually use.

You’ll be able to access it any time, just like an everyday banking account.

It has no set term or repayment, interest Is variable and tends to be higher than a normal variable or fixed rate term loan. There is typically monthly or annual fees and it is important to consider your spending habits with this type of facility.

Here’s What Our Happy Clients Say

Online Home Loans

Lets Find you A Better Home Loan Rate

Book a Complimentary Appointment

We’ll start by getting to know you and understanding your financial goals.

Review your

eligibility

We’ll work out what you can afford to borrow, find lender and product options to suit your situation.

SUBMITTING YOUR HOME LOAN APPLICATION

We will assist with the paperwork, apply for the loan and manage the process to settlement and beyond.